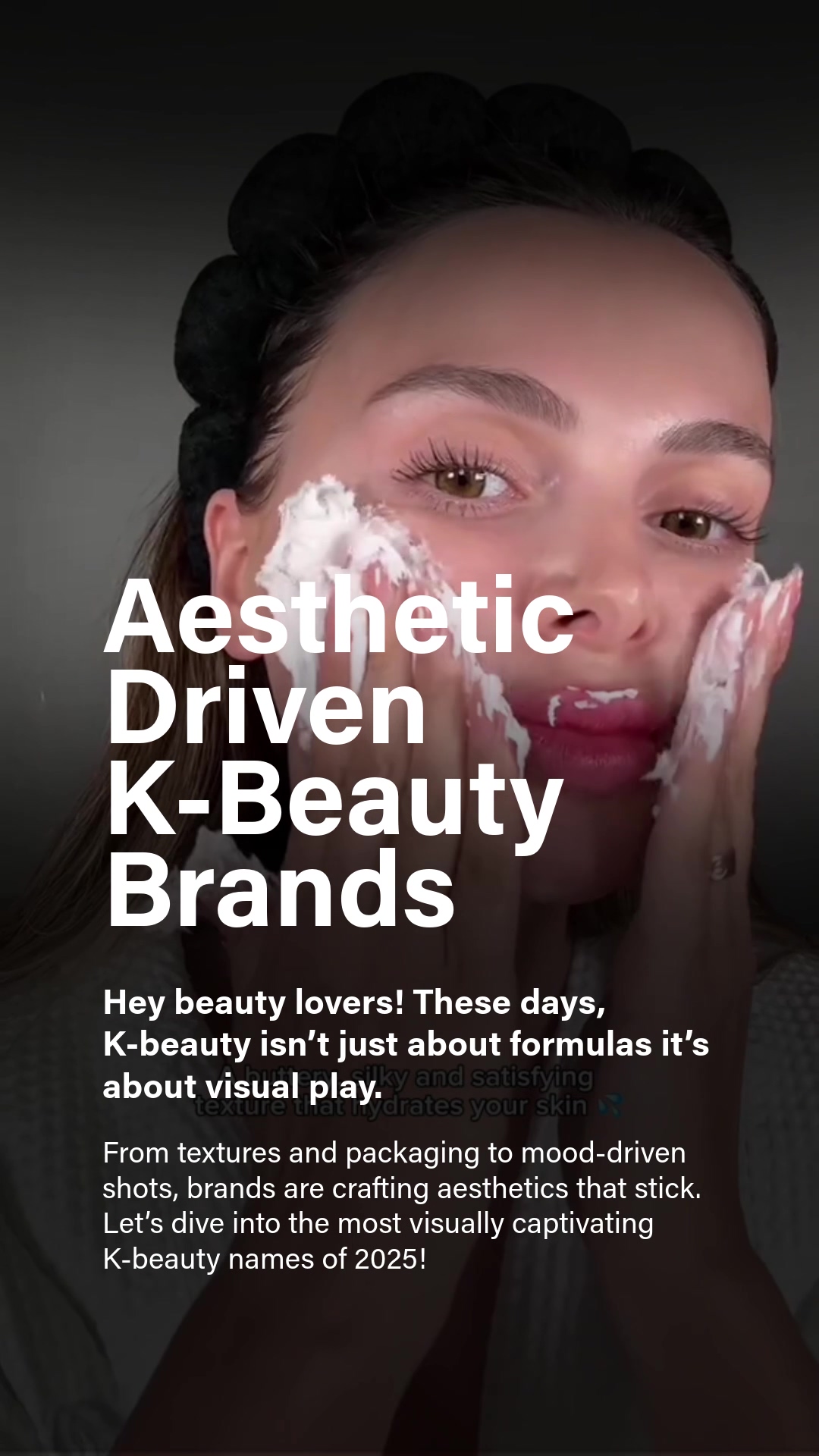

Hey beauty lovers!

These days, K-beauty isn’t just about formulas. it’s about visual play.

From textures and packaging to mood-driven shots, brands are crafting aesthetics that stick.

Let’s dive into the most visually captivating K-beauty names of 2025!

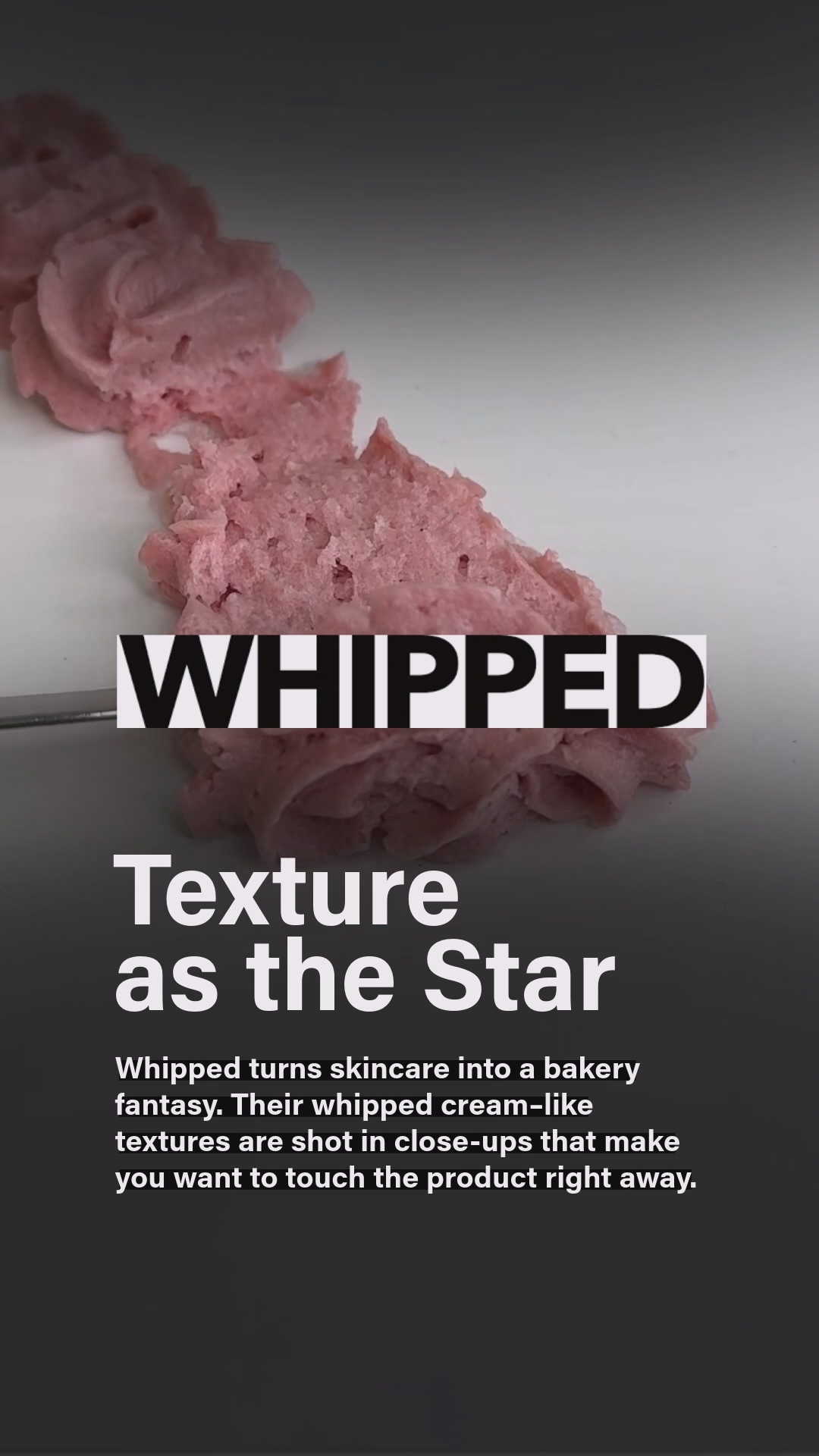

🍰 Whipped <Texture as the Star>

Whipped takes a simple cleanser and turns it into a sensorial fantasy. The brand’s whipped-cream–like formulas are presented in close-up visuals that make texture the main attraction. This approach taps into a larger global trend where consumers want “skincare that feels as good as it looks.” By leaning into food-inspired visuals and playful packaging, Whipped makes routine cleansing look indulgent. a strategy that resonates strongly with Gen Z shoppers on TikTok and Instagram.

💎 Cheriexx <Bold Bullet Glam>

Cheriexx doesn’t shy away from controversy. Its bullet-shaped lipsticks became instantly shareable, sparking buzz across fashion and beauty communities. This provocative design blurs the boundary between cosmetics and cultural statement, giving the brand an edge that fuels word-of-mouth virality. By pairing moody visuals with daring shapes, Cheriexx positions itself less as a makeup line and more as a pop-culture conversation starter.

🍓 Arencia <Tangible Color Play>

Arencia shines by making skincare look almost edible. With products like the Red Smoothie Serum, its jelly textures and vibrant tones are highlighted in glossy product shots. This makes the products immediately “Instagrammable” and enhances consumer trust. because the formula looks fresh, alive, and real. The brand shows how color and tactility can transform skincare visuals into a craving, not just a purchase.

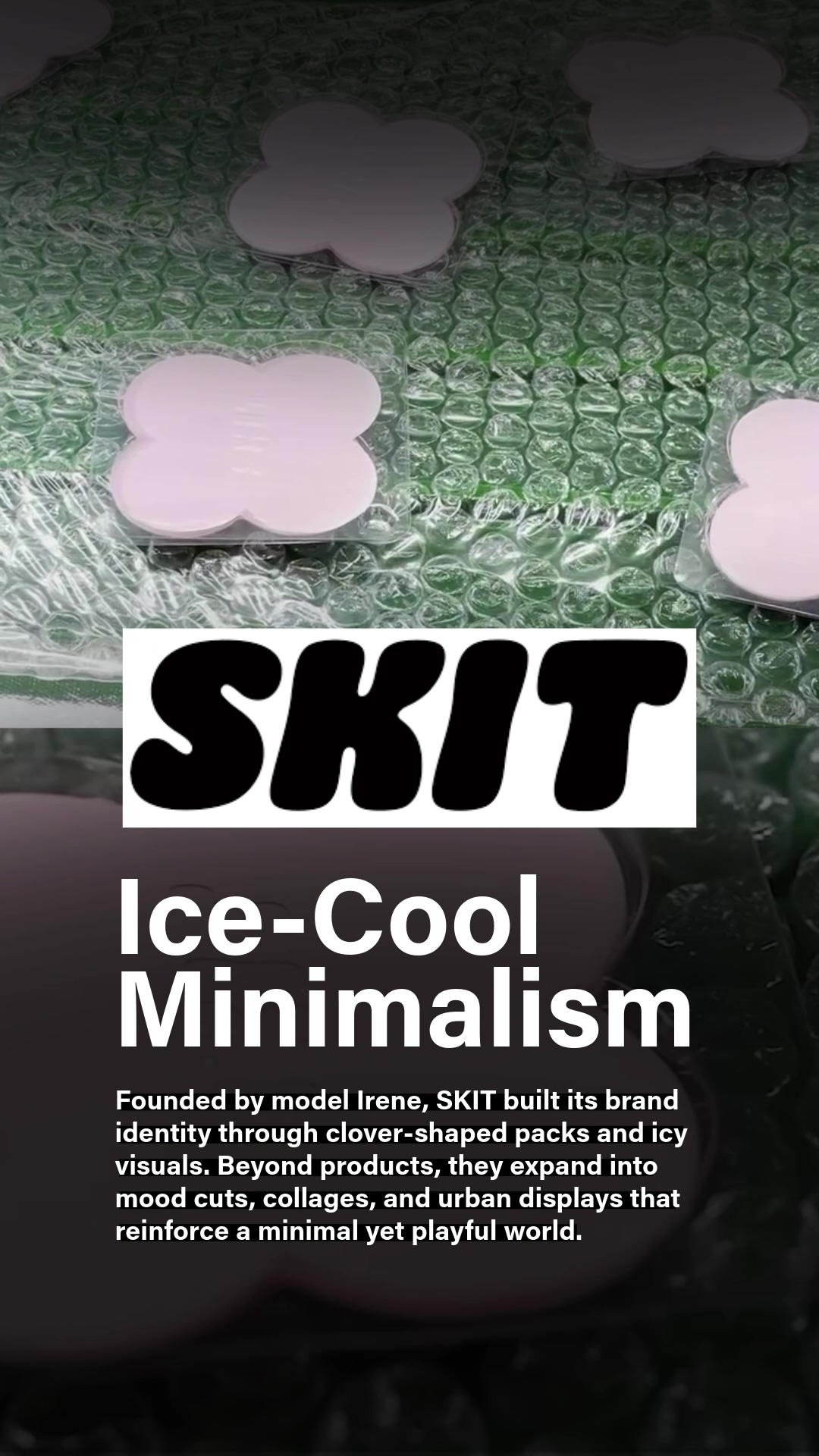

🌿 SKIT <Ice-Cool Minimalism>

Model Irene’s SKIT proves that packaging can be as memorable as the product. With clover-shaped pouches and icy visuals, the brand builds a minimal yet playful aesthetic that feels modern and collectible. SKIT expands its identity through collages, mood cuts, and lifestyle imagery, reinforcing that today’s consumers want more than a product. they want to buy into a visual culture.

📰 Tense <Editorial Beauty Codes>

Tense positions its brow and eye products as if they belong in a glossy magazine spread. The visuals are sharp, editorial, and timeless, combining Japanese minimalism with K-beauty playfulness. This positioning matters because it allows Tense to elevate everyday essentials into fashion accessories, giving consumers not just a tool but an aesthetic experience.

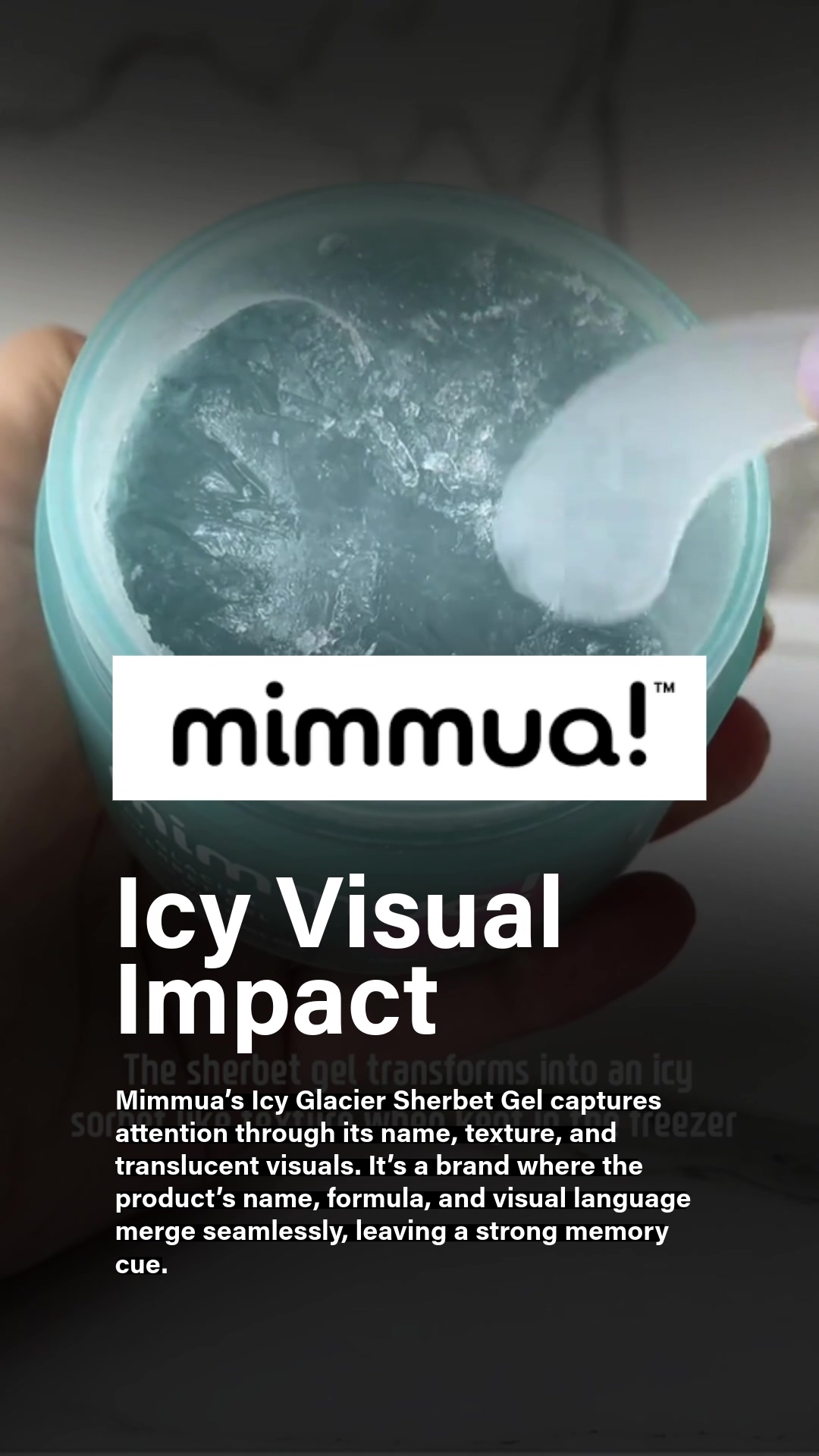

❄️ Mimmua <Icy Visual Impact>

Mimmua is all about sensorial branding. Its Icy Glacier Sherbet Gel isn’t just a skincare product. it’s a complete concept where name, texture, and visuals align. The translucent gel, frozen-inspired packaging, and cooling associations create a product that’s easy to remember and even easier to talk about. This shows how a cohesive aesthetic system can transform a niche item into a viral-ready product.

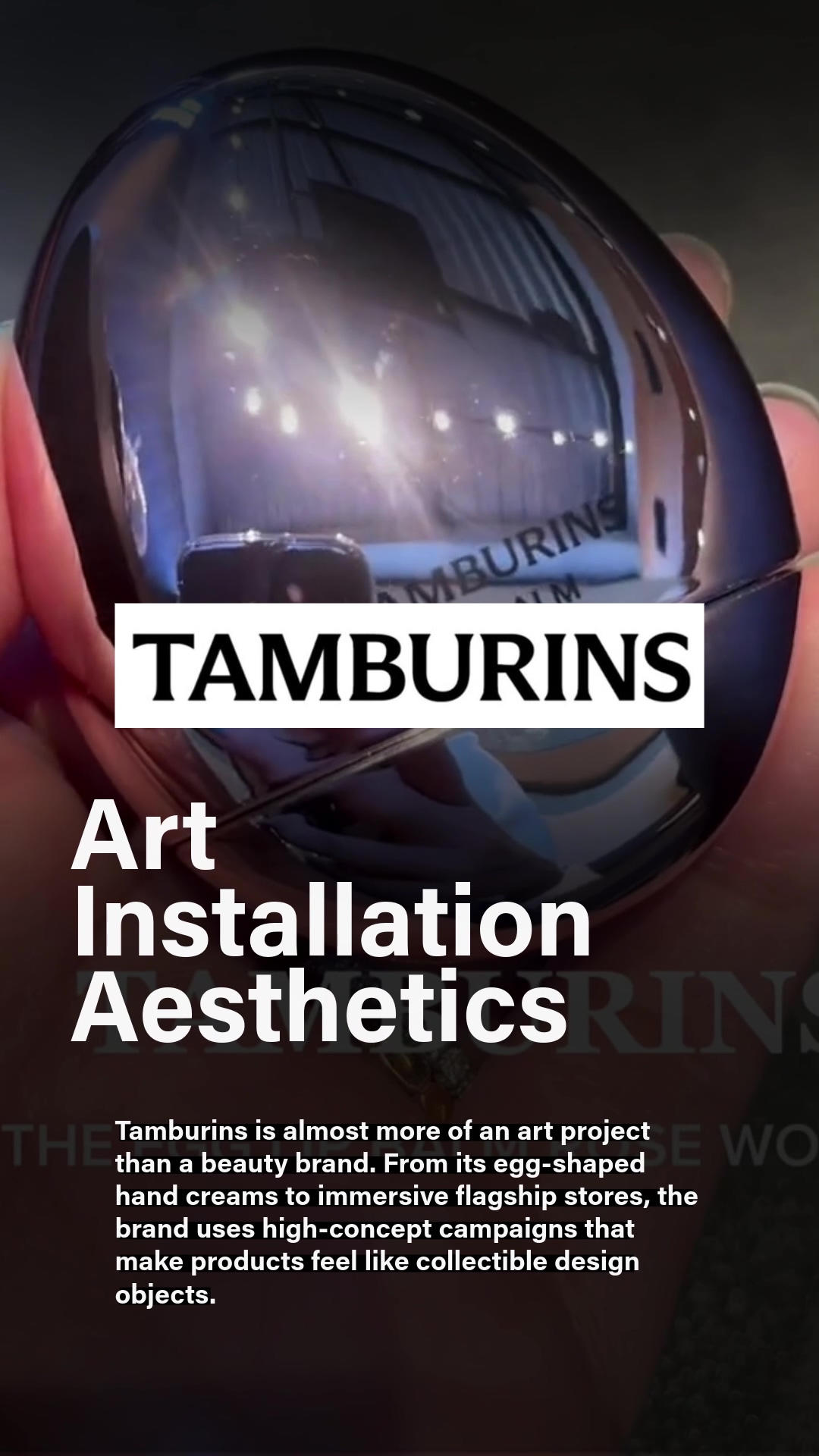

🌹 Tamburins <Art Installation Aesthetics>

Tamburins has transcended traditional retail. With immersive flagship stores, sculptural packaging, and artistic campaigns, it positions itself closer to a gallery than a shop. This strategy not only attracts beauty lovers but also design enthusiasts, proving that beauty can compete with lifestyle and art. By making products feel like collectible objects, Tamburins drives both desirability and cultural capital.

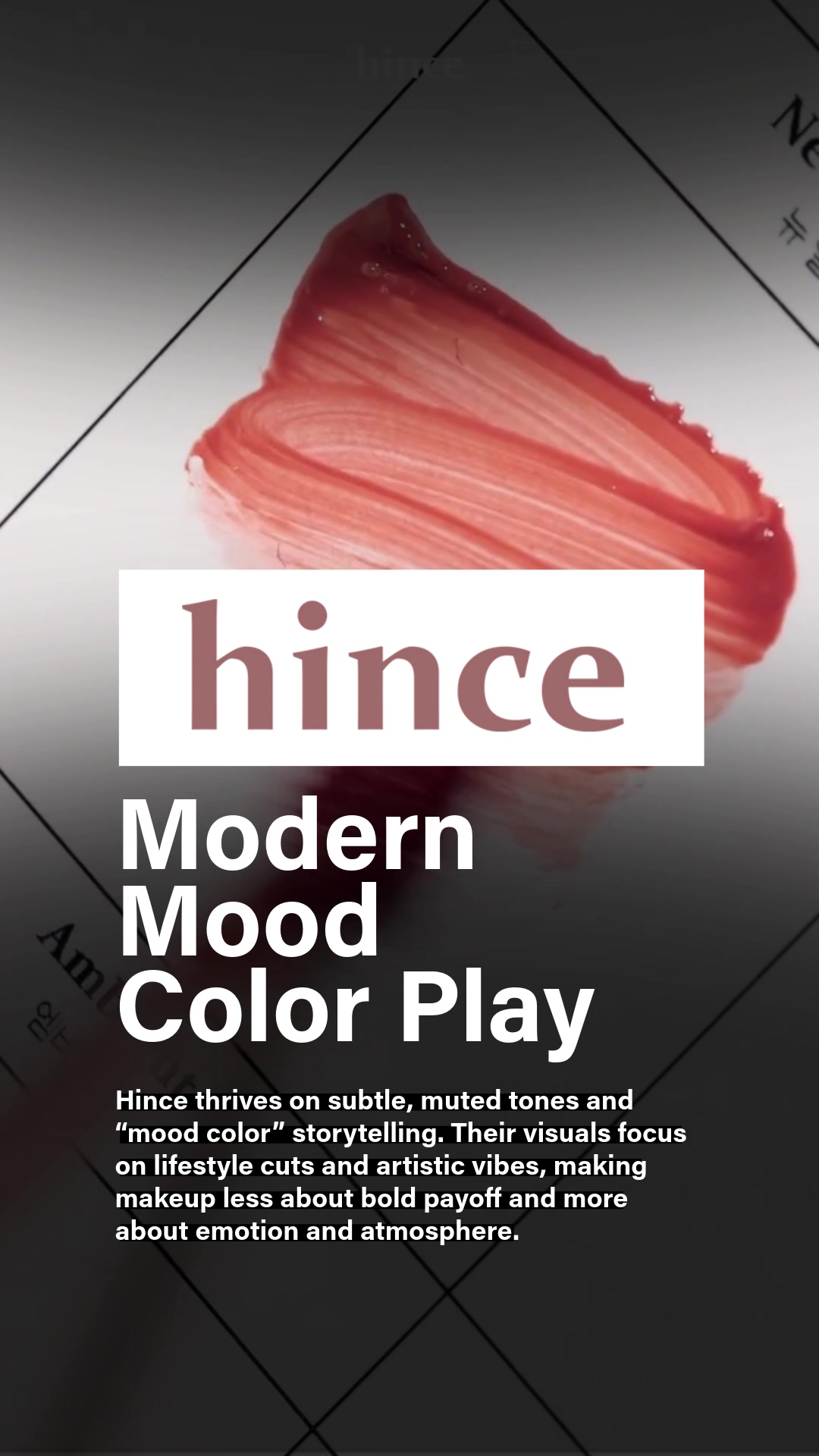

🎨 Hince <Modern Mood Color Play>

Hince built its reputation on “mood-narrative makeup.” Instead of chasing bold pigment, it focuses on subtle, muted tones that communicate feeling and atmosphere. Its visuals lean into lifestyle cuts and emotional storytelling, making makeup less about function and more about how you want to be perceived. This mood-first strategy has made Hince one of the most talked-about brands in global minimalist beauty.

✨ Unleashia <Glitter That Feels Ethical>

Unleashia reclaims glitter for a new generation. By positioning itself as a vegan, eco-conscious brand, it reframes sparkle as both fun and responsible. Product visuals focus on swatches, sparkles, and textures, but always with an editorial finish. This duality. playful yet ethical. appeals directly to Gen Z consumers who want beauty to align with their values without losing excitement.

📊 The Big Picture

In 2025, K-beauty’s competitive edge is less about one miracle ingredient and more about how brands tell their stories visually. From Whipped’s edible textures to Tamburins’ gallery-like spaces, these brands prove that aesthetics are not superficial. they’re strategic. By mastering the visual language of desire, K-beauty continues to shape what global consumers find memorable, shareable, and worth buying.

129Comments

129Comments-

여성정상5 mo. agoIf your product only works with a beauty filter, it doesn’t work

여성정상5 mo. agoIf your product only works with a beauty filter, it doesn’t work -

여성마른5 mo. agoSkincare is not a magic spell, it takes consistency not drama 😅

여성마른5 mo. agoSkincare is not a magic spell, it takes consistency not drama 😅 -

여성예민한5 mo. agoWhipped turning cleanser texture into the hero is so Gen Z

여성예민한5 mo. agoWhipped turning cleanser texture into the hero is so Gen Z -

여성콤비네이션5 mo. agoOMG bullet-shaped lipsticks??

여성콤비네이션5 mo. agoOMG bullet-shaped lipsticks?? -

여성마른5 mo. agowow looks interesting

여성마른5 mo. agowow looks interesting -

여성예민한5 mo. agoMimmua’s Icy Glacier Sherbet Gel nails cohesion: name, texture, visuals all match

여성예민한5 mo. agoMimmua’s Icy Glacier Sherbet Gel nails cohesion: name, texture, visuals all match 여성예민한5 mo. agoI really love this product

여성예민한5 mo. agoI really love this product 여성기름진5 mo. ago@여성/예민한 same! my summer fave gel cream

여성기름진5 mo. ago@여성/예민한 same! my summer fave gel cream 남성예민한5 mo. agoHow is this product in real life? Does it actually tighten pores?

남성예민한5 mo. agoHow is this product in real life? Does it actually tighten pores? 여성마른5 mo. ago@남성/예민한 The pores do look smaller right away because of the cooling, but the main benefits are cooling and light hydration.

여성마른5 mo. ago@남성/예민한 The pores do look smaller right away because of the cooling, but the main benefits are cooling and light hydration. 여성예민한5 mo. ago@남성/예민한 The cooling effect is legit.

여성예민한5 mo. ago@남성/예민한 The cooling effect is legit. -

여성콤비네이션5 mo. agoThese brands look stunning, but do they perform or just photograph well?

여성콤비네이션5 mo. agoThese brands look stunning, but do they perform or just photograph well? 여성예민한5 mo. agoMimmua’s cooling gel and Hince textures perform for me pretty and practical

여성예민한5 mo. agoMimmua’s cooling gel and Hince textures perform for me pretty and practical 여성정상5 mo. ago@여성/예민한 Post your routines and results pls

여성정상5 mo. ago@여성/예민한 Post your routines and results pls -

여성콤비네이션5 mo. agoOoh Bullet-shaped lipsticks are attention-bait. cheap shock value.

여성콤비네이션5 mo. agoOoh Bullet-shaped lipsticks are attention-bait. cheap shock value. -

여성콤비네이션5 mo. agoASMR-style texture videos would supercharge these brands

여성콤비네이션5 mo. agoASMR-style texture videos would supercharge these brands -

여성기름진5 mo. agoTbh the videos that promote stuff like this are mostly exaggerated

여성기름진5 mo. agoTbh the videos that promote stuff like this are mostly exaggerated 여성콤비네이션5 mo. agoFOR REAL Overexaggerating everything just makes me trust the product less

여성콤비네이션5 mo. agoFOR REAL Overexaggerating everything just makes me trust the product less 남성마른5 mo. agototally agree

남성마른5 mo. agototally agree 여성정상5 mo. agoand can we retire the “pretend to drink your serum” trend already lol

여성정상5 mo. agoand can we retire the “pretend to drink your serum” trend already lol 남성예민한5 mo. agoI swear they waste more product in one video than I use in a month

남성예민한5 mo. agoI swear they waste more product in one video than I use in a month -

여성정상5 mo. agoHow is the whipped one?

여성정상5 mo. agoHow is the whipped one? -

여성콤비네이션5 mo. agoHince’s mood-first palettes feel like wardrobe basics for the face quiet but incredibly buildable.

여성콤비네이션5 mo. agoHince’s mood-first palettes feel like wardrobe basics for the face quiet but incredibly buildable. -

여성기름진5 mo. agoTamburins turning stores into galleries makes me visit even when I don’t need skincare. pure destination retail.

여성기름진5 mo. agoTamburins turning stores into galleries makes me visit even when I don’t need skincare. pure destination retail. 여성정상5 mo. agoreal. 😂😂

여성정상5 mo. agoreal. 😂😂 -

여성Combination5 mo. agoThe whole “aesthetic-first” wave looks gorgeous on TikTok, but I’m not sure it survives bad lighting and real commutes.

여성Combination5 mo. agoThe whole “aesthetic-first” wave looks gorgeous on TikTok, but I’m not sure it survives bad lighting and real commutes. -

여성Oily5 mo. agoWe’re celebrating textures like they’re the main course, but INCI and stability still decide if I repurchase.

여성Oily5 mo. agoWe’re celebrating textures like they’re the main course, but INCI and stability still decide if I repurchase. -

여성Dry5 mo. agoI feel like creators push vibes faster than brands can verify claims

여성Dry5 mo. agoI feel like creators push vibes faster than brands can verify claims -

여성Sensitive5 mo. agoThe faster the viral cycle, the shorter the product memory do we even finish a jar before the next look?

여성Sensitive5 mo. agoThe faster the viral cycle, the shorter the product memory do we even finish a jar before the next look? 여성Oily5 mo. agoFacts. My “holy grail” lasts like… three trends. Then a new texture drops and I’m feral again

여성Oily5 mo. agoFacts. My “holy grail” lasts like… three trends. Then a new texture drops and I’m feral again 여성Combination5 mo. agoMy combo skin barely remembers last month’s serum LMAO

여성Combination5 mo. agoMy combo skin barely remembers last month’s serum LMAO 여성Dry5 mo. agoEmpties used to feel like a flex; now it’s a miracle.

여성Dry5 mo. agoEmpties used to feel like a flex; now it’s a miracle. 여성Dry5 mo. agoNot me realizing my SPF expires before I hit the halfway mark. That’s the real scandal.

여성Dry5 mo. agoNot me realizing my SPF expires before I hit the halfway mark. That’s the real scandal. 여성Combination5 mo. agoThe faster the trend, the faster the dupe so why commit?

여성Combination5 mo. agoThe faster the trend, the faster the dupe so why commit? 여성Sensitive5 mo. agoLow-buy 2025 saved me. One in, one out. If it doesn’t beat my current fave by 20%, it stays on the shelf.

여성Sensitive5 mo. agoLow-buy 2025 saved me. One in, one out. If it doesn’t beat my current fave by 20%, it stays on the shelf. 여성정상5 mo. agoStop FOMO

여성정상5 mo. agoStop FOMO -

여성Sensitive5 mo. agoIt’s wild how fast routines inflate: primer-for-primer, topper-for-topper…

여성Sensitive5 mo. agoIt’s wild how fast routines inflate: primer-for-primer, topper-for-topper… 여성Sensitive5 mo. agowallets can’t keep up

여성Sensitive5 mo. agowallets can’t keep up -

여성콤비네이션5 mo. agoI’m getting aesthetic fatigue everything is mood boards, no substance.

여성콤비네이션5 mo. agoI’m getting aesthetic fatigue everything is mood boards, no substance. 여성기름진5 mo. agothe visuals pulled me into skincare in the first place, function came after.

여성기름진5 mo. agothe visuals pulled me into skincare in the first place, function came after. -

FemaleCombination5 mo. agoMimmua’s name texture visuals alignment is tight; travel climate tests (heat/cold) would seal trust.

FemaleCombination5 mo. agoMimmua’s name texture visuals alignment is tight; travel climate tests (heat/cold) would seal trust. -

FemaleOily5 mo. agostate microplastic policy front-and-center Gen Z reads labels closely here.

FemaleOily5 mo. agostate microplastic policy front-and-center Gen Z reads labels closely here. -

FemaleNormal5 mo. agoThe visuals are stunning, I still want one plain daylight photo without filters.

FemaleNormal5 mo. agoThe visuals are stunning, I still want one plain daylight photo without filters. -

FemaleSensitive5 mo. agoEverything is mood boards lately, give me INCI and stability so I can trust.

FemaleSensitive5 mo. agoEverything is mood boards lately, give me INCI and stability so I can trust. -

FemaleDry5 mo. agoWhipped style shots look tasty, cleanse off clean or it is a no from me.

FemaleDry5 mo. agoWhipped style shots look tasty, cleanse off clean or it is a no from me. -

FemaleNormal5 mo. agocheriexx provokes, fine, but comfort and long wear must match the noise.

FemaleNormal5 mo. agocheriexx provokes, fine, but comfort and long wear must match the noise. -

FemaleCombination5 mo. agoSKIT feels collectible, please add refills so it is not endless plastic.

FemaleCombination5 mo. agoSKIT feels collectible, please add refills so it is not endless plastic. -

FemaleOily5 mo. agoI am bored of glossy macros, show pores and texture or I scroll.

FemaleOily5 mo. agoI am bored of glossy macros, show pores and texture or I scroll. -

FemaleNormal5 mo. agoTense makes brows feel premium, tiny spoolies in caps would be practical.

FemaleNormal5 mo. agoTense makes brows feel premium, tiny spoolies in caps would be practical. -

FemaleOily5 mo. agoMimmua cooling vibe is perfect for heat, publish TEWL changes not just copy.

FemaleOily5 mo. agoMimmua cooling vibe is perfect for heat, publish TEWL changes not just copy. -

FemaleDry5 mo. agoTamburins looks like a gallery, love it, pricing must respect ml and grams.

FemaleDry5 mo. agoTamburins looks like a gallery, love it, pricing must respect ml and grams. -

FemaleNormal5 mo. agoHince mood tones flatter olive, please add more multi tone swatches.

FemaleNormal5 mo. agoHince mood tones flatter olive, please add more multi tone swatches. -

FemaleSensitive5 mo. agoUnleashia sparkle is fun, microplastic policy should sit front and center.

FemaleSensitive5 mo. agoUnleashia sparkle is fun, microplastic policy should sit front and center. -

FemaleNormal5 mo. agoStop selling only vibes, routine order matters, list AM and PM steps.

FemaleNormal5 mo. agoStop selling only vibes, routine order matters, list AM and PM steps. -

FemaleCombination5 mo. agoBullet lipstick discourse again, offer a neutral shell for folks who hate the symbol.

FemaleCombination5 mo. agoBullet lipstick discourse again, offer a neutral shell for folks who hate the symbol. -

Non-binarySensitive5 mo. agoASMR texture videos are cool, add captions for accessibility please.

Non-binarySensitive5 mo. agoASMR texture videos are cool, add captions for accessibility please. -

FemaleNormal5 mo. agoI am tired of same same color grading, show skin in cloudy daylight too.

FemaleNormal5 mo. agoI am tired of same same color grading, show skin in cloudy daylight too. -

FemaleOily5 mo. agoRegional edits please, matte soft edge plays better in the Gulf than glitter.

FemaleOily5 mo. agoRegional edits please, matte soft edge plays better in the Gulf than glitter. -

FemaleNormal5 mo. agoCollabs are fine, credit artists and MUAs, pay them, then I will buy.

FemaleNormal5 mo. agoCollabs are fine, credit artists and MUAs, pay them, then I will buy. -

FemaleOily5 mo. agoIf your cleanser leaves film, the whole aesthetic collapses, I am angry.

FemaleOily5 mo. agoIf your cleanser leaves film, the whole aesthetic collapses, I am angry. -

MaleNormal5 mo. agoPretty is great, pretty with proof is what makes me repurchase.

MaleNormal5 mo. agoPretty is great, pretty with proof is what makes me repurchase. -

FemaleDry4 mo. agoWhipped shots look tasty, if the cleanser leaves a film it's a hard no for me.

FemaleDry4 mo. agoWhipped shots look tasty, if the cleanser leaves a film it's a hard no for me. -

MaleNormal4 mo. agoI need one plain daylight photo, no filter, just pores and texture so I can trust the look.

MaleNormal4 mo. agoI need one plain daylight photo, no filter, just pores and texture so I can trust the look. -

FemaleSensitive4 mo. agoUNLEASHIA sparkle is fun, please state the microplastic policy clearly on the page.

FemaleSensitive4 mo. agoUNLEASHIA sparkle is fun, please state the microplastic policy clearly on the page. -

FemaleNormal4 mo. agocheriexx is bold, cool, long wear and comfort need to match the noise or I'm out.

FemaleNormal4 mo. agocheriexx is bold, cool, long wear and comfort need to match the noise or I'm out. -

FemaleCombination4 mo. agoSKIT feels collectible, add refills and recycled pouches to cut the plastic.

FemaleCombination4 mo. agoSKIT feels collectible, add refills and recycled pouches to cut the plastic. -

FemaleNormal4 mo. agoBeautiful, genuinely.

FemaleNormal4 mo. agoBeautiful, genuinely. -

FemaleCombination4 mo. agoMimmua sherbet language makes me expect a cooling feel. Please share in use temperature testing.

FemaleCombination4 mo. agoMimmua sherbet language makes me expect a cooling feel. Please share in use temperature testing. -

FemaleNormal4 mo. agoTense eye looks pair well with simple skin. One coat of tubing mascara and I am out the door.

FemaleNormal4 mo. agoTense eye looks pair well with simple skin. One coat of tubing mascara and I am out the door. -

FemaleOily4 mo. agoAesthetic branding is my kryptonite instant add‑to‑cart.

FemaleOily4 mo. agoAesthetic branding is my kryptonite instant add‑to‑cart. -

FemaleSensitive4 mo. agoAesthetic‑led brands are my weakness photogenic textures instant like.

FemaleSensitive4 mo. agoAesthetic‑led brands are my weakness photogenic textures instant like. -

FemaleNormal4 mo. agoAny metrics tying design to PDP conversion?

FemaleNormal4 mo. agoAny metrics tying design to PDP conversion? -

MaleSensitive4 mo. agowhipped branding is playful. I need clear surfactant info to see if my skin will tolerate it.

MaleSensitive4 mo. agowhipped branding is playful. I need clear surfactant info to see if my skin will tolerate it. -

FemaleNormal4 mo. agoHince palettes lean neutral. I build quick looks with two shades and a balm, no fuss.

FemaleNormal4 mo. agoHince palettes lean neutral. I build quick looks with two shades and a balm, no fuss. -

FemaleSensitive4 mo. agoUNLEASHIA glitter looks fun on video. I would use it for one event and keep my base minimal.

FemaleSensitive4 mo. agoUNLEASHIA glitter looks fun on video. I would use it for one event and keep my base minimal. -

FemaleOily4 mo. agoMimmua icy gel sounds perfect for August heat. I hope it sinks fast and does not leave a film.

FemaleOily4 mo. agoMimmua icy gel sounds perfect for August heat. I hope it sinks fast and does not leave a film. -

FemaleDry4 mo. agoAesthetic brands stop my scroll visuals matter.

FemaleDry4 mo. agoAesthetic brands stop my scroll visuals matter. -

MaleNormal4 mo. agocheriexx bullets get attention. I just want safety caps that lock well inside a warm bag, for sure.

MaleNormal4 mo. agocheriexx bullets get attention. I just want safety caps that lock well inside a warm bag, for sure. -

FemaleOily4 mo. agoMinimalist packs read ‘clinical’ sometimes balance is key.

FemaleOily4 mo. agoMinimalist packs read ‘clinical’ sometimes balance is key. -

MaleNormal4 mo. agoArencia jelly shots make me want to cleanse right away. If the slip is low I could use daily.

MaleNormal4 mo. agoArencia jelly shots make me want to cleanse right away. If the slip is low I could use daily. -

FemaleOily4 mo. agoAesthetic brands own my heart so screenshot‑able 📸

FemaleOily4 mo. agoAesthetic brands own my heart so screenshot‑able 📸 -

FemaleCombination4 mo. agoSKIT pouches are cute for the gym. I like light packaging that does not crack in a tote, no worries.

FemaleCombination4 mo. agoSKIT pouches are cute for the gym. I like light packaging that does not crack in a tote, no worries. -

FemaleSensitive4 mo. agoAny proof design → conversion lift?

FemaleSensitive4 mo. agoAny proof design → conversion lift? -

MaleNormal4 mo. agoSome aesthetics feel loud online and quiet in person. I want testers under natural light.

MaleNormal4 mo. agoSome aesthetics feel loud online and quiet in person. I want testers under natural light. -

FemaleDry4 mo. agoMinimalist but warm wins; sterile can feel cold.

FemaleDry4 mo. agoMinimalist but warm wins; sterile can feel cold. -

FemaleNormal4 mo. agoTamburins stores look like galleries. I go to touch textures and leave with a candle, clever move.

FemaleNormal4 mo. agoTamburins stores look like galleries. I go to touch textures and leave with a candle, clever move. -

FemaleSensitive4 mo. agoRebrands that actually worked? examples pls.

FemaleSensitive4 mo. agoRebrands that actually worked? examples pls. -

FemaleDry4 mo. agoPhotogenic textures are such scroll‑stoppers rn.

FemaleDry4 mo. agoPhotogenic textures are such scroll‑stoppers rn. -

FemaleCombination4 mo. agoAny metrics tying visuals to PDP conversion? I love data so much.

FemaleCombination4 mo. agoAny metrics tying visuals to PDP conversion? I love data so much. -

FemaleNormal4 mo. agoScroll‑stopper.

FemaleNormal4 mo. agoScroll‑stopper. -

FemaleNormal4 mo. agoConversion lift data?

FemaleNormal4 mo. agoConversion lift data? -

FemaleDry4 mo. agoHince mood colors are gentle. I reach for them on office days when I want quiet makeup.

FemaleDry4 mo. agoHince mood colors are gentle. I reach for them on office days when I want quiet makeup. -

FemaleOily4 mo. agoAny metrics linking visuals to PDP conversion lift?

FemaleOily4 mo. agoAny metrics linking visuals to PDP conversion lift? -

FemaleNormal4 mo. agoUNLEASHIA claims vegan glitter. I would like to see the exact base material listed.

FemaleNormal4 mo. agoUNLEASHIA claims vegan glitter. I would like to see the exact base material listed. -

FemaleDry4 mo. agoTamburins sculpture bottles are display pieces. Refills would make that design last longer.

FemaleDry4 mo. agoTamburins sculpture bottles are display pieces. Refills would make that design last longer. -

FemaleNormal4 mo. agocheriexx is a conversation starter. Shade names that are easy to read in store help a lot.

FemaleNormal4 mo. agocheriexx is a conversation starter. Shade names that are easy to read in store help a lot. -

FemaleNormal4 mo. agoTense brow visuals read editorial. Do the pencils survive a sweaty commute, that is my test.

FemaleNormal4 mo. agoTense brow visuals read editorial. Do the pencils survive a sweaty commute, that is my test. -

FemaleOily4 mo. agoMinimalist + warm works; sterile‑clinical can feel cold on shelf.

FemaleOily4 mo. agoMinimalist + warm works; sterile‑clinical can feel cold on shelf. -

FemaleDry4 mo. agoMinimalist but warm > cold clinical for me

FemaleDry4 mo. agoMinimalist but warm > cold clinical for me -

FemaleNormal4 mo. agoI enjoy brands that design for touch. If the cap clicks and the pump is smooth, I remember it.

FemaleNormal4 mo. agoI enjoy brands that design for touch. If the cap clicks and the pump is smooth, I remember it. -

FemaleSensitive4 mo. agoArencia colour stories tempt me to try vitamin rich cleansers. I will patch test first.

FemaleSensitive4 mo. agoArencia colour stories tempt me to try vitamin rich cleansers. I will patch test first. -

FemaleNormal4 mo. agoAesthetic brands own my scroll.

FemaleNormal4 mo. agoAesthetic brands own my scroll. -

FemaleCombination4 mo. agowhipped textures photograph so well. If the cleanser rinses clean I am sold for travel.

FemaleCombination4 mo. agowhipped textures photograph so well. If the cleanser rinses clean I am sold for travel. -

MaleNormal4 mo. agoThis round up reminds me that packaging tells a story. I still buy when INCI and testing back it up.

MaleNormal4 mo. agoThis round up reminds me that packaging tells a story. I still buy when INCI and testing back it up. -

FemaleSensitive4 mo. agoTexture shots are doing the most lately.

FemaleSensitive4 mo. agoTexture shots are doing the most lately. -

MaleNormal4 mo. agoSKIT clover shape is memorable. I hope the spout seals tight so it does not leak in flights.

MaleNormal4 mo. agoSKIT clover shape is memorable. I hope the spout seals tight so it does not leak in flights. -

FemaleOily4 mo. agoTexture shots are winning feeds rn.

FemaleOily4 mo. agoTexture shots are winning feeds rn. -

FemaleOily4 mo. agoWarm minimalism > cold clinical IMO.

FemaleOily4 mo. agoWarm minimalism > cold clinical IMO. -

FemaleSensitive4 mo. agoMinimalist packs can read ‘clinical’ balance is everything.

FemaleSensitive4 mo. agoMinimalist packs can read ‘clinical’ balance is everything. -

FemaleSensitive4 mo. agoExamples of rebrands that moved the needle?

FemaleSensitive4 mo. agoExamples of rebrands that moved the needle? -

FemaleNormal3 mo. agoim here for playful textures. if the formula performs, i dont mind a pretty jar. give me steady results and im good.

FemaleNormal3 mo. agoim here for playful textures. if the formula performs, i dont mind a pretty jar. give me steady results and im good. -

FemaleNormal2 mo. agoFun concept and the bottle is cute, yet I am not moved to switch from my current routine.

FemaleNormal2 mo. agoFun concept and the bottle is cute, yet I am not moved to switch from my current routine. -

MaleCombination2 mo. agoIt feels like the same gel texture in a different jar. What makes this formula different from last season?

MaleCombination2 mo. agoIt feels like the same gel texture in a different jar. What makes this formula different from last season? -

MaleNormal2 mo. agoi’ve seen three lookalike gels this month, bit of a trend chase more than innovation.

MaleNormal2 mo. agoi’ve seen three lookalike gels this month, bit of a trend chase more than innovation. -

MaleCombination2 mo. agoCurious about preservatives. Is it phenoxyethanol only or a blend with chelators for a water rich serum?

MaleCombination2 mo. agoCurious about preservatives. Is it phenoxyethanol only or a blend with chelators for a water rich serum? -

MaleSensitive2 mo. agolooks great on video, but some TikTok influencer ads feel exaggerated to me. i want straight claims and patch-test advice.

MaleSensitive2 mo. agolooks great on video, but some TikTok influencer ads feel exaggerated to me. i want straight claims and patch-test advice. -

MaleOily2 mo. agoToo much viral push lately. I see the same reels everywhere and it puts me off!

MaleOily2 mo. agoToo much viral push lately. I see the same reels everywhere and it puts me off! -

MaleNormal2 mo. agoI like the refill idea if the pump is recyclable. Check the material and stated waste rates before buying.

MaleNormal2 mo. agoI like the refill idea if the pump is recyclable. Check the material and stated waste rates before buying. -

FemaleCombination2 mo. agopretty jars are fun, but i skip if the inci list is vague or the preservative system isn’t clear!

FemaleCombination2 mo. agopretty jars are fun, but i skip if the inci list is vague or the preservative system isn’t clear! -

FemaleDry2 mo. agoThe brand story is cool! I will wait for minis to see if it works in hard water days.

FemaleDry2 mo. agoThe brand story is cool! I will wait for minis to see if it works in hard water days. -

FemaleDry2 mo. agocurious about the cushion balm texture you mentioned. is the slip from silicones or from emollient esters?

FemaleDry2 mo. agocurious about the cushion balm texture you mentioned. is the slip from silicones or from emollient esters? -

FemaleNormal2 mo. agoInteresting launch calendar, although the naming trend feels copy paste from other lines!

FemaleNormal2 mo. agoInteresting launch calendar, although the naming trend feels copy paste from other lines! -

Non-binarySensitive2 mo. agoPretty lip tint but the scent is loud. I would prefer fragrance free versions.

Non-binarySensitive2 mo. agoPretty lip tint but the scent is loud. I would prefer fragrance free versions. -

Non-binarySensitive2 mo. agoLooks aesthetic for the shelf, sure, but is there any clinical data beyond a user survey of thirty people?

Non-binarySensitive2 mo. agoLooks aesthetic for the shelf, sure, but is there any clinical data beyond a user survey of thirty people? -

FemaleDry2 mo. agoIf the brand leads with colour stories, what are the stability tests behind the pigments and fragrance?

FemaleDry2 mo. agoIf the brand leads with colour stories, what are the stability tests behind the pigments and fragrance? -

Non-binaryCombination2 mo. agoDesign is fun. Please list examples where the sensorial finish matches long-wear comfort so buyers know what to try first.

Non-binaryCombination2 mo. agoDesign is fun. Please list examples where the sensorial finish matches long-wear comfort so buyers know what to try first. -

FemaleCombination2 mo. agoI tried a tester. Finish felt silky at first then peeled under sunscreen. Anyone else?

FemaleCombination2 mo. agoI tried a tester. Finish felt silky at first then peeled under sunscreen. Anyone else? -

FemaleSensitive2 mo. agoThe packaging is pretty but I need to know what the actives are and at what level before I buy.

FemaleSensitive2 mo. agoThe packaging is pretty but I need to know what the actives are and at what level before I buy. -

MaleOily2 mo. agoWho decided these were the top aesthetic brands? Was it sales, editor picks, or user retention?

MaleOily2 mo. agoWho decided these were the top aesthetic brands? Was it sales, editor picks, or user retention?